MDB Stock: A Promising Investment Opportunity

In recent years, MongoDB, Inc. (MDB) has emerged as a formidable player in the highly competitive database market, boasting an impressive track record of innovation and growth. MDB’s stock has garnered significant attention from investors seeking long-term value appreciation. This article provides an in-depth analysis of MDB stock, exploring its historical performance, key drivers, and future prospects.

Strong Historical Performance

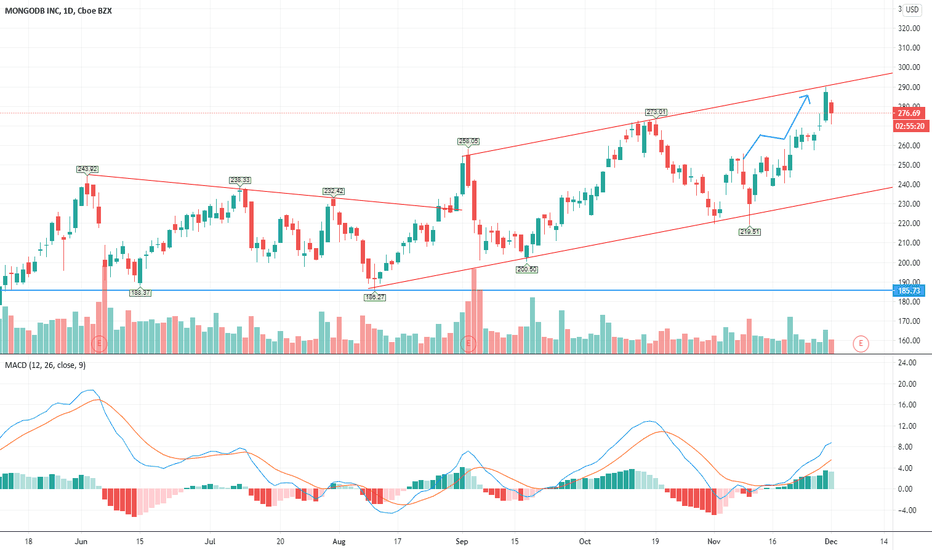

MDB stock has consistently outperformed the broader market indices over the past few years. In 2020, despite the economic challenges posed by the COVID-19 pandemic, MDB shares surged by over 100%, significantly outpacing the NASDAQ Composite Index. This impressive growth momentum continued in 2021, with MDB stock rising by an additional 60%, further solidifying its position as one of the top-performing technology stocks.

Key Business Drivers

MDB’s success can be attributed to several fundamental business drivers. First, the company’s MongoDB database platform is widely recognized as a best-in-class solution for modern applications that require high performance, scalability, and flexibility. MongoDB’s document-oriented database model and distributed architecture enable developers to build and deploy data-intensive applications with ease.

Second, MDB has established a strong customer base across a diverse range of industries, including technology, healthcare, financial services, and retail. The company’s focus on providing enterprise-grade solutions has resonated with customers seeking a reliable and scalable database platform for their mission-critical applications.

Expansion into New Markets

MDB is actively expanding its operations into new markets, both geographically and in terms of product offerings. The company is investing heavily in cloud computing, offering its MongoDB Atlas database service as a fully managed cloud-based solution. This move is expected to drive significant growth as more businesses adopt cloud technologies.

Additionally, MDB is developing new products and services to meet the evolving needs of its customers. The company’s recent acquisition of Realm, a leading mobile database provider, demonstrates its commitment to providing a comprehensive suite of database solutions for modern applications.

Future Outlook

The future outlook for MDB stock is promising. The global database market is expected to grow at a compound annual growth rate (CAGR) of approximately 15% over the next five years, creating a significant growth opportunity for MDB. Furthermore, the company’s strong financial performance and continued innovation position it well to capture a significant share of this growing market.

Analysts are optimistic about MDB’s long-term prospects. Consensus estimates predict that MDB revenue will increase by an average of 25% annually over the next five years. This growth is expected to be driven by the company’s expanding customer base, product innovation, and increasing adoption of cloud computing.

Conclusion

MDB stock has proven to be a rewarding investment for shareholders over the past few years. The company’s strong business fundamentals, impressive growth trajectory, and commitment to innovation make it an attractive option for long-term investors seeking consistent returns. As the database market continues to expand and MDB captures an increasing share, the stock is poised for continued appreciation in value.

See you again in another interesting article!